Self-employed individuals can often face challenges when applying for a cash advance. They may not have a W-2 to provide to lenders, and may not have a steady flow of income. While these conditions can be challenging, there are still some ways to show that you are a good candidate for a self-employed loan. Here are some tips to help you get started. In addition to having a steady income, you must also have a positive credit history.

Having a bad credit score may prevent you from qualifying for a cash advance. Banks use a risk assessment model to determine whether or not to provide funding to you. They look at things like your credit score and credit history to determine if you are a good risk. While a high credit score may be enough to secure a cash advance, low credit scores and no credit history are red flags for banks.

When applying for a self-employed cash advance, make sure you have all the necessary documents on hand. Your government-issued ID, proof of income, and checking account information are essential. Some lenders may require a social security number or a voided check, but the most convenient way to prove income is by bank statements. Most lenders will want to see at least three months of bank statements. Tax returns can also be used to prove your income.

A self-employed borrower 20000 loan may be required to provide two tax returns. The schedule SE Form reveals how much income you earn and how much money you owe in taxes to the federal government. The lender wants to be sure that you’re paying your taxes, since errors on your tax return can trigger an IRS audit. This wouldn’t be good for the lender! Lastly, a self-employed borrower should have several weeks’ worth of bank records to show a consistent stream of income.

Self-employed people can use a co-signer to make their loan application stand a better chance of being approved. A co-signer can help you get a lower interest rate. Remember that your co-signer will be considered when the lender determines whether or not to give you the loan. It’s important to consider your co-signer’s credit history before signing on the dotted line.

A self-employed person can also request a loan online if they’re unsure of their eligibility. You can usually get an answer within 90 seconds. If you’re rejected, you can try again a week later. It’s important to remember that lenders change their eligibility criteria frequently. Therefore, it’s best to check before applying for a self-employed loan. This will help you make sure you meet the criteria for the loan.

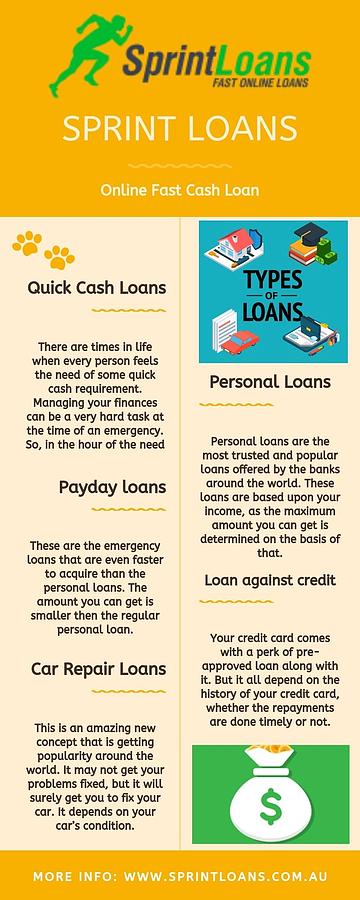

If you’re self-employed, you can find it difficult to apply for a traditional payday loan. A self-employed loan is an ideal solution for those situations where you need fast money, but don’t have access to your savings account. This type of loan is made possible with the documents and resources you provide. Unlike traditional payday loans, a cash advance for self-employed individuals helps you get the money you need without having to wait until payday. All you need to do is fill out an application with the company that offers the loan and write a check for the amount you want. The lender will charge a fee for the service.

Cash advances are a quick and easy way to get the funds you need, but they are expensive. You should know your credit line and be sure to pay it back as soon as you can. Usually, a credit line for a cash advance is limited to a percentage of your overall credit line. You also need to know the terms and conditions, since you’ll be charged interest as soon as you borrow the money.

If you’re self-employed, you may be able to get a cash advance through your credit card. This type of loan is usually easier to qualify for than a payday loan, but it still has its limitations. Since it’s not a long-term solution, it’s best to consider another option, such as an installment loan.